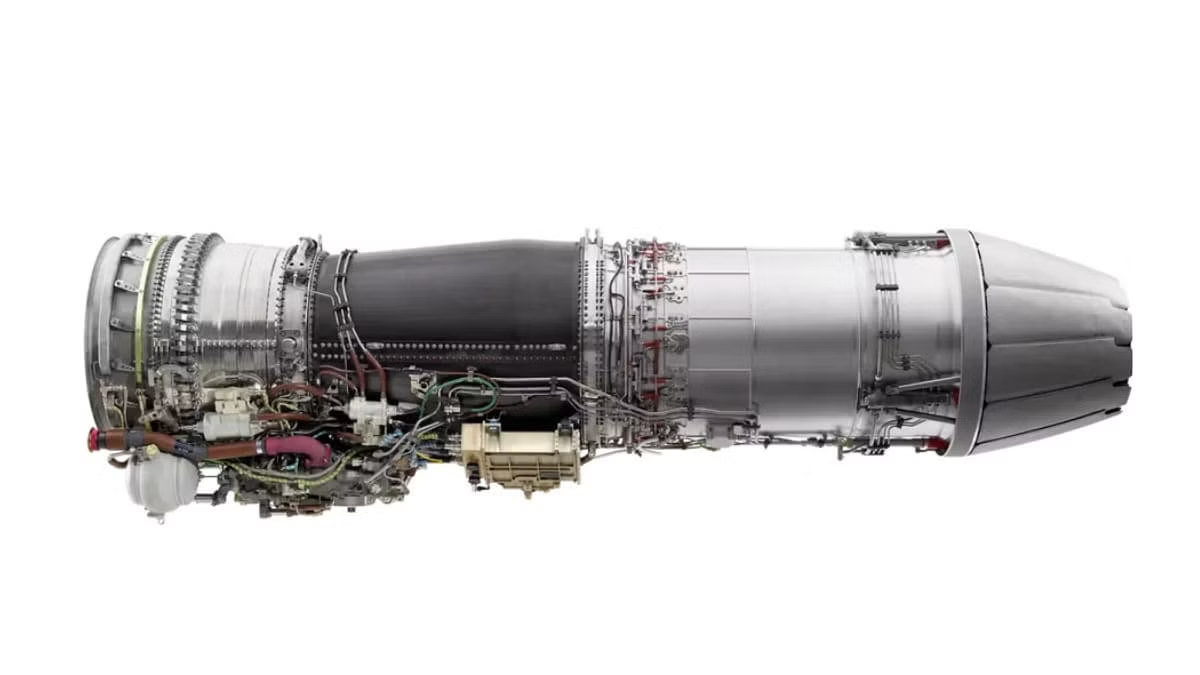

Defence cooperation – as a cornerstone of the US-India strategic partnership- is viewed as critical for expediting India’s military modernisation, defence industry’s indigenisation, and to increase India’s defence exports. In this context, the signing of a $716 million worth deal between United States’ General Electrics and India’s Hindustan Aeronautics Limited (HAL) in 2021 is considered to be a major landmark. As per the deal, the HAL was to procure 99 GE-manufactured F-404 IN20 engines, that were to power India’s Light Combat Aircraft Tejas Mk1As. However, in preceding years, General Electric has been falling behind on delivery schedules.

Latest: towards the end of October 2024, the GE informed HAL that the delivery – initially scheduled to be made in March/ April 2023 – was to be delayed till April 2025. While GE attributed the delay to supply chain disruptions, yet in New Delhi, it was speculated to be a pressure tactic by the Biden administration.

Nevertheless, under the upcoming Trump administration the engines’ delivery can be further delayed. While Washington has been concerned over the transfer of critical military technologies, the tendency has only grown since the onset of the Russia-Ukraine conflict. The conflict has highlighted the significance of safeguarding critical technologies so as to maintain an edge in military capabilities and also to prevent their misuse. In addition, President-elect Donald Trump is also expected to double down on his trade policies. During his election campaign, Trump was particularly critical of India’s protectionist trade policies. The stance has not changed much following his electoral win either. Most recently, he has threatened to impose reciprocal tariffs on India, owing to New Delhi’s excessively high tariffs on imports from America.

During President Trump’s previous stint in power, India-US defence trade thrived. India had followed through the high-value purchases of Boeing AH-64E Apache helicopters and MH-60 Seahawk helicopters from U.S. From a strategic standpoint, the purchases were aimed at boosting India’s defence capabilities. However, from a commercial standpoint, the sales were largely favourable to the U.S arms industries. In addition, the signing of the Communications Compatibility and Security Agreement (COMCASA) in 2018 and the Basic Exchange and Cooperation Agreement (BECA) in 2020 emerged as the major highlights of US-India defence technology cooperation during the Trump administration.

Despite extensive defence cooperation, bilateral military technology cooperation has lagged in recent years. A key irritant, in this regard, are strict legislations – the Arms Export Control Act (AECA) 1976, and the International Traffic Arms Regulations – which place stringent restrictions on transfer of critical technologies. U.S concerns over transfer of technology particularly came to fore in October 2024, when U.S State Department announced the sanctioning of 400 entities and individuals for transferring critical technologies to Russia. The sanctioned entities included 19 Indian companies and two individuals, who were providing dual-use critical components that the Russian weapons system relies on.

Hence, amid the recent developments, which are indicative of Washington’s increasing concerns over transfer of technology, the highly prized jet engine technology, which is “crown jewel” of U.S military technology, may be, if not withheld, then at least delayed to India. Particularly in prelude to New Delhi’s energy-related purchases and its hesitation in aligning with the western line vis-à-vis Ukraine, as well as its apparently emerging thaw with China along border, Washington is well-expected to be reluctant in pursuing co-production or technology transfers to India. The series of events unfolding particularly after the Russia-Ukraine conflict has demonstrated that, unlike the NATO allies, New Delhi’s partnership with Washington is primarily driven by transactional interests. With regards to the subject deal as well, it is also pertinent to mention here, that while the agreement was expected to offer an estimated 80% transfer of technology, however critical technologies such as the single-crystal blade casting process and the software for the Full Authority Digital Engine Control (FADEC) system were already retained by GE to safeguard its intellectual property.

In the lieu of the delay in the delivery of engines, the induction of Tejas Mk1A aircrafts – scheduled until 2029-2030 – to the Indian Airforce is expected to be further delayed. With HAL already being compelled to adjust its production timelines, it is estimated that the production timelines have been pushed back by around 11 months. To mitigate the impact, HAL is also reported of planning to utilize Category-B F-404 engines – which include reserve or previously unused engines from earlier contracts with GE reserve engines – for pre-delivery flights of the Tejas Mk1A.

In addition to this the integration of Active Electronically Scanned Array radars and electronic warfare suites on the aircraft requires procurement from Israel’s Elta Systems, a subsidiary of Israel Aerospace Industries, which as well is pending. Meanwhile, the engine charge amplifier, another critical component has to be sourced from Denmark. The supply of these amplifiers has also been delayed resulting from the placement of the engine charge amplifier on Denmark’s export blacklist. The multiplicity of stakeholders and technology providers involved in the production of the Tejas Mk 1A fighter jets also places a question mark over the notion of the aircrafts being an indigenous and a home-grown enterprise.

The ensuing delay in the induction of the Tejas Mk 1As, which are to replace Mig-21s – commonly known as ‘flying coffins’ – will impede the military preparedness of the IAF. Other associated challenges could be cost overruns resulting from delays and ensuing makeshift arrangements, as well as delays in force planning, trainings, and fleet management, and maintenance strategies. It shall also hurt New Delhi’s ambitions of selling the Tejas Mk 1A aircrafts to Egypt, Argentina, and Malaysia. Dampening of India’s defence indigenisation goals would indeed follow. In the larger context of U.S-India relations, a probable delay shall be indicative of Washington’s cautious approach towards New Delhi amid New Delhi’s bid to diversify its defence procurement to reduce its dependency on traditional arms and weapon systems suppliers like Russia. While within New Delhi, Washington could be viewed as tightening the noose around it, and therefore, may lead to the emergence of irritants in the bilateral strategic relationship.

Maryam Raashed

- Maryam Raashed#molongui-disabled-link